Introduction to Medicare's Parts

Medicare has four main parts: A, B, C and D.

- Parts A and B are often referred to as "Original Medicare." This is a fee-for-service health plan operated by the federal government.

- Part C is called a Medicare Advantage Plan or Medicare Health Plan. Individuals may purchase these plans through private insurance companies approved by Medicare or their certified independent insurance agents.

- You also have the option of getting prescription drug (Part D) coverage, called a Part D Plan, and additional coverage called Medicare Supplement Insurance (“Medigap”).

- You must be enrolled in Parts A and B to sign up for Part C or Part A and/or B to sign up for Part D.

Medicare's Parts in Detail

- Covers hospital stays, skilled nursing facilities, some home-health services and hospice care

- Medicare pays an approved amount for each type of care.

- There is no monthly premium, but you must pay a yearly deductible before Medicare will cover hospital costs.

- You are eligible to enroll in Part A starting three months before the month of your 65th birthday, during the month of your 65th birthday, and in the three months after your 65th birthday month.

- Medicare Part A covers care at Cedars-Sinai Medical Center.

- Covers doctor visits, some home-health services, laboratory tests, X-rays, and other outpatient care, including some medical supplies and equipment.

- This is optional coverage and requires that you pay a monthly premium.

- You are eligible to enroll in Part B starting three months before the month of your 65th birthday, during the month of your 65th birthday, and in the three months after your 65th birthday month.

- If you opt out of Part B during this initial enrollment period, then decide to enroll at a later date, you may have to pay a higher premium. Your monthly premium for Part B may go up 10 percent for each year you were eligible for but did not enroll in Part B.

- Medicare Part B covers care from Cedars-Sinai and most of our physicians.

- Part C, also known as Medicare Advantage or a Medicare Health plan, is purchased from a private insurance company approved by Medicare and typically organized like a Health Maintenance Organization (HMO) or Preferred Provider Organization (PPO) insurance plan.

- Part C puts coverage from both Part A and Part B into one plan. Most of these plans also include Medicare Part D prescription drug coverage.

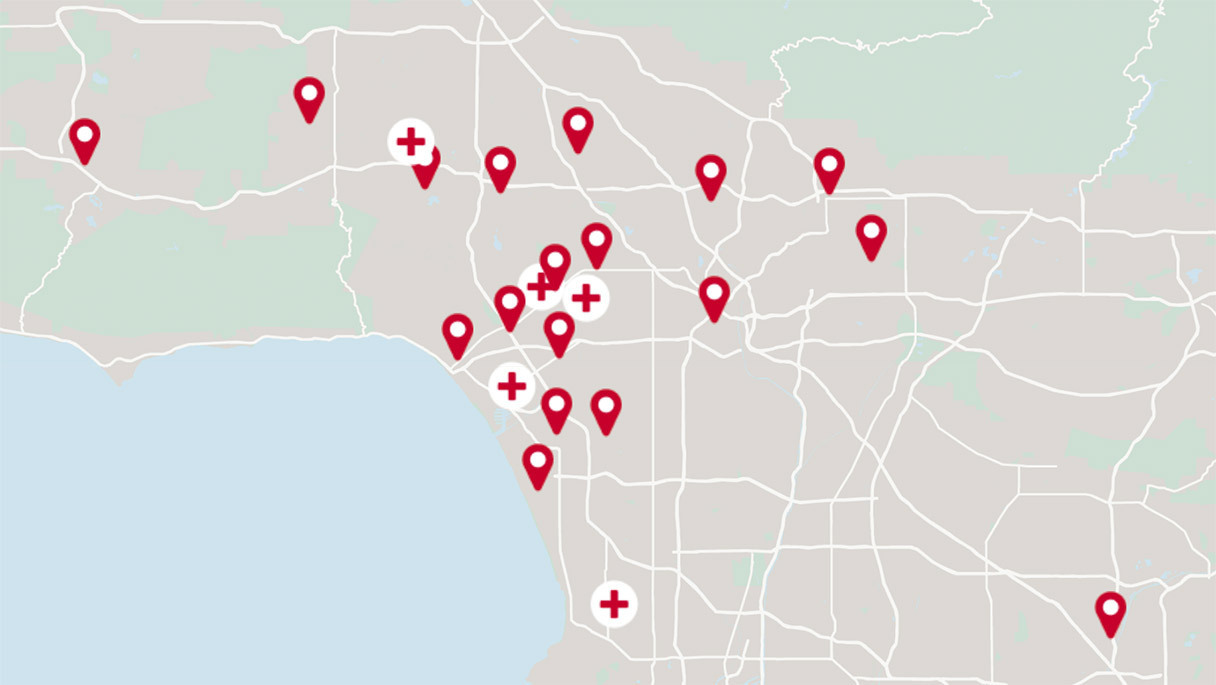

- Cedars-Sinai participates in the following Medicare Advantage plans:

- Alignment Health Plan

- Alignment Health AVA (PPO) 007

- Blue Shield of California

- Blue Shield 65 Plus (HMO)

- Blue Shield 65 Plus (HMO) Group

- Blue Shield AdvantageOptimum Plan 1 (HMO)

- Blue Shield AdvantageOptimum Plan 2 (HMO)

- Blue Shield Balance Plan (HMO)

- Blue Shield Inspire (HMO)

- Blue Shield 65 Plus Plan 2 (HMO)

- Blue Shield AdvantageOptimum Plan (HMO)

- Blue Shield Inspire (HMO D-SNP)

- Blue Shield TotalDual Plan (HMO D-SNP)

- Blue Shield Vital (HMO)

- UnitedHealthcare

- AARP Medicare Advantage from UHC CA-004P (HMO-POS)

- AARP Medicare Advantage from UHC CA-0026 (PPO)

- AARP Medicare Advantage from UHC CA-0029 (PPO)

- AARP Medicare Advantage from UHC CA-0019 (HMO-POS)

- AARP Medicare Advantage from UHC CA-0013 (HMO-POS)

- SCAN

- SCAN Inspired by women for women (HMO)

- Alignment Health Plan

If you receive benefits from a former employer or union trust, it’s possible a Medicare Advantage PPO benefit plan has been made available to you. Cedars-Sinai and many of its physicians also participate in the Medicare Advantage PPO provider networks of the following insurers: Anthem Blue Cross, Blue Shield, UnitedHealthcare.

If you are enrolled in an HMO plan, you must choose a primary care doctor in either the Cedars-Sinai Medical Group or Cedars-Sinai Health Associates HMO provider networks and be referred to specialists within these groups. These plans have options that include Part D coverage.

- Covers prescription drugs

- Part D Plans are optional coverage that may require a monthly premium, and possibly a deductible and/or copays for your medications.

- Most Medicare Advantage (Part C) plans include Part D coverage.

- You should review a plan’s formulary and compare prices for the prescription drugs you need when shopping for Part D coverage. Medicare’s website at www.Medicare.gov has a benefit plan shopping tool where you can enter your prescription information to find the best plan formulary match for you.

- If you have health insurance through your employer, you should receive an annual letter letting you know whether your health plan meets the minimum government requirements. The letter is called a Letter of Creditable Coverage. If your employer plan doesn’t meet the minimum government requirements, you may consider signing up for Part D coverage.

- If you want prescription drug coverage it is mandatory that you sign up for Part D as soon as you are eligible for Medicare Parts A and B. If you don't sign up, you will be charged a penalty of 1 percent of the national average premium cost for Part D coverage based on the number of months you didn’t have creditable prescription drug coverage.

Other Medicare Options to Consider

Medicare supplement insurance—also called "Medigap"—is an additional insurance product that pays some of Medicare's out-of-pocket costs such as copays and deductibles and possibly other services not normally covered by Original Medicare. You must have Medicare Parts A and B to buy a Medigap policy. People with Medicare Advantage plans, however, do not need and cannot use Medigap policies.

Your Younger Spouse

If your younger spouse is covered by your employer-provided health insurance and will be losing that coverage as you retire, he or she will have a window of time during which they can enroll in a new plan through the Covered California exchange, an insurance broker or directly from an insurance company.

Information updated May 5, 2023.

Need Help?

If you have questions about coverage or referrals, we’re here to help.

Available 7 days a week, 6 am - 9 pm PT.

Effective July 1, 2017, California implemented consumer protection laws protecting patients from receiving "surprise bills" from physicians in certain circumstances when a physician is providing services at an in-network facility. If Cedars-Sinai is considered in-network and a physician is out of network and providing non-emergent services, unless receiving prior consent, the physician might be legally restricted in the amount he/she can bill patients beyond what a patient would expect under the terms of their commercial health plan. The law is complex and there are several exceptions to the rules. If you have questions or complaints, please contact the California Department of Managed Health Care at 888-466-2219.

Medicare Enrollment

See the different enrollment periods, including initial, special and open, and figure out when you can enroll.

Glossary

Get definitions to terms, abbreviations and acronyms related to billing, insurance and financial assistance.

Coverage for Beneficiaries

Get details about the program at Cedars-Sinai, which includes both traditional and Advantage plans.